In an era where data reliability and document traceability are paramount, invoice digitization becomes a performance lever. Utilizing a solution like Weproc allows you to centralize, validate, and automate invoice processing while ensuring legal compliance.

What Does the Law Say About Mandatory Information on a Supplier Invoice?

In the UK, the HMRC requires invoices to include specific details for them to be valid. Similarly, in the US, while there is no federal mandate for invoice content, certain information is expected for tax and accounting purposes. In Spain, invoices must comply with the requirements set by the Agencia Tributaria.

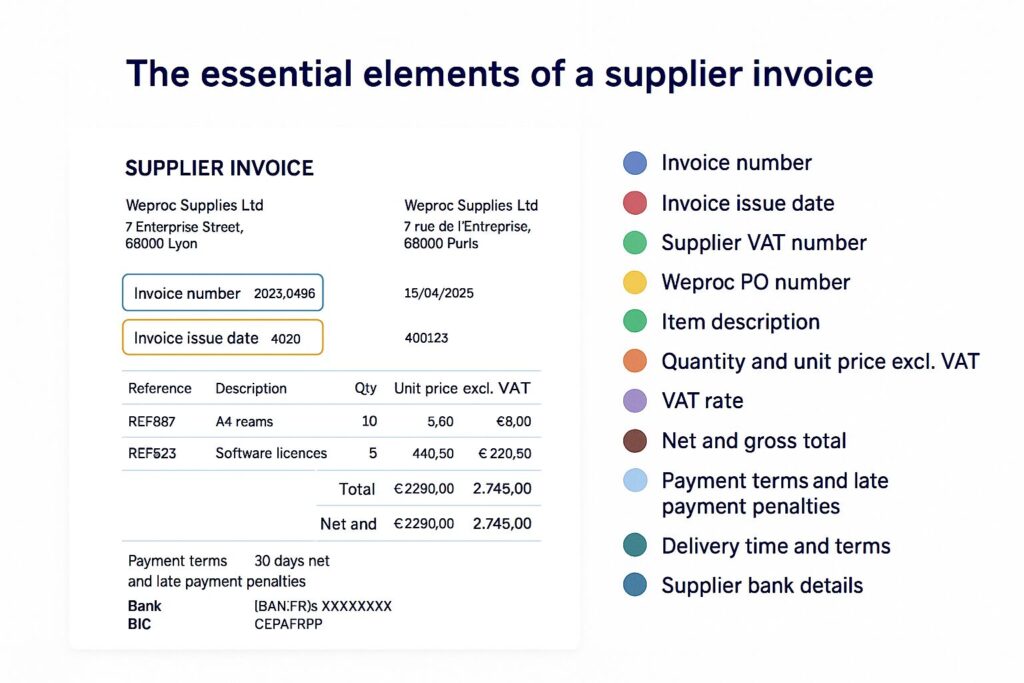

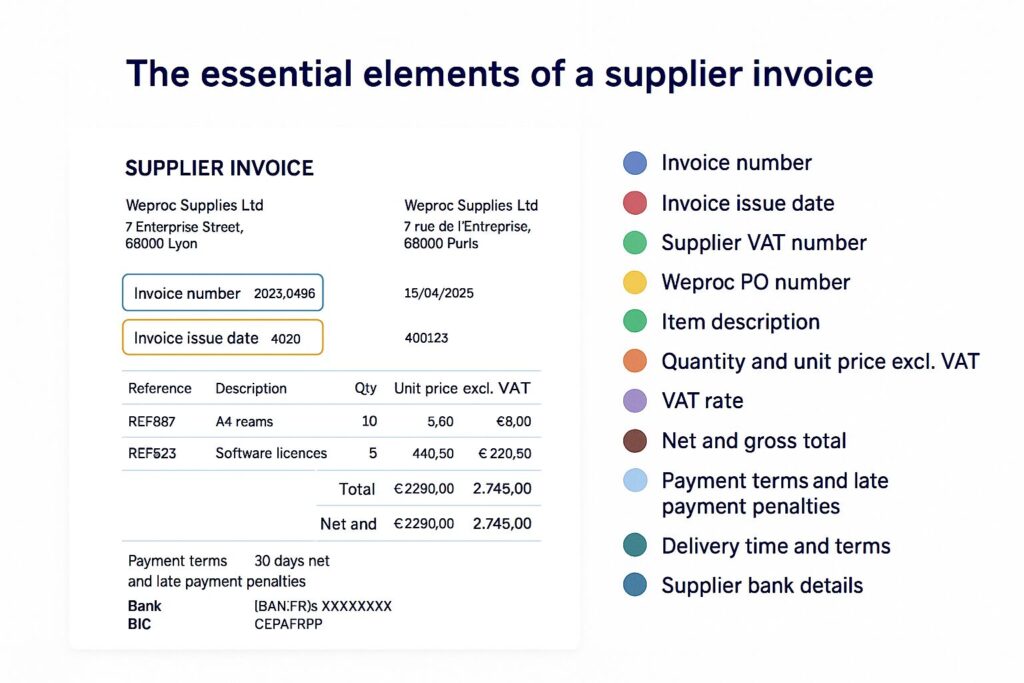

Mandatory Information on an Invoice

- Invoice issue date

- Unique invoice number based on a sequential order

- Date of supply of goods or services

- Supplier’s identity: company name, address, VAT number (if applicable)

- Buyer’s identity: name, address, VAT number (if applicable)

- Detailed description of goods or services

- Quantities and unit prices

- Applicable discounts or rebates

- Net amount, applicable tax rates, total amount including taxes

- Payment due date

- Payment terms and conditions

- Late payment penalties

Practical Example

A supplier delivers 10 printers to a company. The invoice must specify the quantity, unit price, applicable VAT (e.g., 20%), delivery date, and total amount. Without this information, the invoice may be legally challenged.

In a digitized procurement context, this data must be well-structured to integrate seamlessly into management systems like Weproc.

Recommended but Non-Mandatory Information

- IBAN / BIC to facilitate bank transfers

- Purchase order or delivery note number

- Internal client reference

- Personalized notes (thank you messages, contact names, etc.)

Including the purchase order number, while not mandatory, is highly recommended as it simplifies the reconciliation process between the invoice and the corresponding order, reducing manual entry errors and speeding up payment processing.

Integrating this information into a procurement management solution like Weproc ensures consistent data interpretation, minimizes manual re-entry, and reduces human errors. Weproc automates data collection through OCR technology, dedicated email addresses for invoice import, and a supplier portal for secure and controlled exchanges with external partners. This intelligent system streamlines processing, accelerates the matching of purchase orders, receipts, and invoices, and ensures full compliance at every step.

Penalties for Non-Compliance with Invoicing Rules

- Financial penalties for missing mandatory information

- Rejection of tax deductions (e.g., VAT)

- Potential audits and legal consequences

Good to Know

Recovering VAT is contingent upon receiving a compliant invoice. A non-compliant supplier invoice poses accounting risks for the company.

A Procure-to-Pay system like Weproc can generate alerts for non-compliant invoices, preventing entry errors and mitigating fiscal risks.

What Happens If Invoice Conditions Are Not Met?

If goods are delivered late or do not meet specifications, invoicing conditions may be disputed. Receipt management plays a crucial role here.

In case of disputes, tools like Weproc’s receipt module help verify delivery compliance and document anomalies, serving as a basis for contesting invoices or requesting credit notes.

Case Study: This dual traceability of purchase and receipt is vital for financial departments aiming to strengthen internal controls while streamlining supplier relationships.

Specific Mentions for Particular Cases

- Reverse charge VAT: Mandatory mention “Reverse charge” with reference to the applicable article

- Construction subcontracting: Indicate the main contractor and the relevant project

- Intra-community invoices: Mention “VAT exempt – Article 262 ter I of the CGI” (for EU countries)

Digitization: Towards Fully Compliant Invoicing

Electronic invoicing is becoming mandatory in various countries, with specific timelines and requirements. For instance, in Spain, B2B electronic invoicing will be mandatory starting January 2025 for companies with an annual turnover exceeding €8 million, and for all other businesses by 2026. In the UK and the US, while not yet mandatory, electronic invoicing is encouraged to improve efficiency and compliance.

Using a Partner Dematerialization Platform (PDP) like Weproc ensures standardized invoice formats, improved quality, and compliance with technical standards required by tax authorities.

Companies utilizing Weproc for managing supplier invoices, combined with PDP and receipt modules, benefit from automatic verification of matches between orders, deliveries, and invoices. This coherence enhances internal control quality and significantly reduces errors and supplier disputes.

For more information: What is Factur-X?

Want to learn more about our Weproc procurement management software?

Contact us or request your 15-minute demo below!